Investors Beware: This Surtax Is Creeping Up on You

Investors Beware: This Surtax Is Creeping Up on You

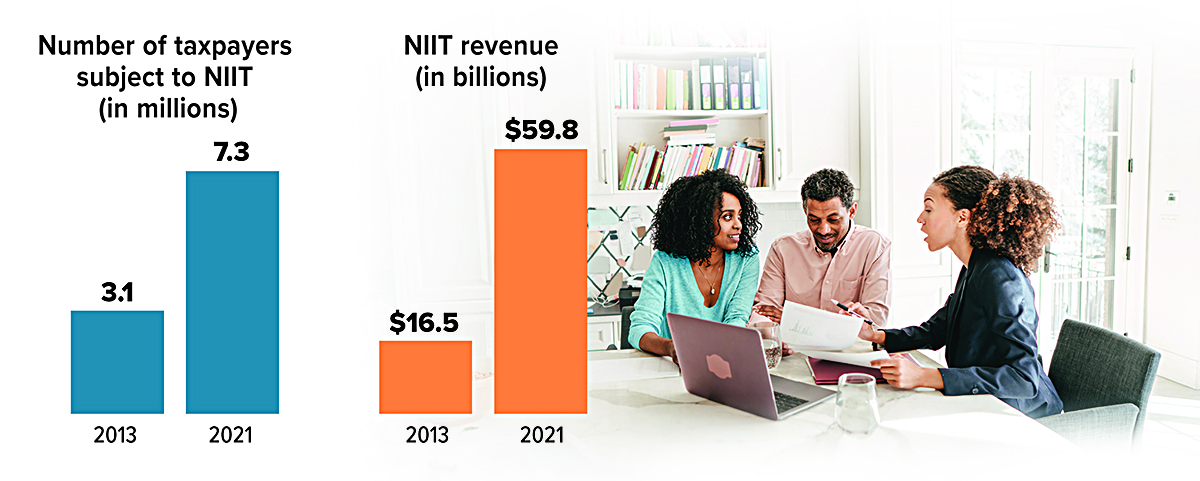

High-income taxpayers are subject to a 3.8% net investment income tax (NIIT) from capital gains, dividends, interest, certain royalties, rents, and passive income if their modified adjusted gross income (MAGI) exceeds $200,000 for single filers or $250,000 for married joint filers. The number of taxpayers paying the NIIT has more than doubled since it took effect, mostly because these income thresholds were not indexed to inflation, and the revenue collected has more than tripled.

Susan H. Stewart, CPM, JD,

Senior Vice President – Financial Advisor

Senior Portfolio Manager – Portfolio Focus

NMLS #830330 through City National Bank

Individual CA License # 0M18772

RBC Wealth Management, a division of RBC Capital Markets, LLC | Firm CA License # 0C38863

Ph: (302) 493-9161 | e-mail: susan.h.stewart@rbc.com

The Stewart Group - RBC Wealth Management - Home

RBC Wealth Management, a division of RBC Capital Markets, LLC | Firm CA License #0C38863

Ph: (301) 907-2705 | e-mail: taylor.stewart@rbc.com

Investment and insurance products offered through RBC Wealth Management are not insured by the FDIC or any other federal government agency, are not deposits or other obligations of, or guaranteed by, a bank or any bank affiliate, and are subject to investment risks, including possible loss of the principal amount invested.

The information contained herein is based on sources believed to be reliable, but its accuracy cannot be guaranteed. RBC Wealth Management does not provide tax or legal advice. All decisions regarding the tax or legal implications of your investments should be made in connection with your tax or legal advisor. RBC Wealth Management is not a mortgage lender or broker. Nothing herein should be construed as an offer or commitment to lend. Any calculations are provided as educational tools, and are not intended to provide investment advice or serve as a financial plan. The result of any calculation performed is hypothetical and does not assume the effect of fees, commissions, tax rates, or changes in interest rates or the rate of inflation, and is not intended to predict or guarantee the actual results of any investment product or strategy. These results depend wholly upon the information provided by you and the assumptions utilized within. In selecting an anticipated investment return, you should consider factors affecting the potential return, such as investment objectives and risk tolerance. The articles and opinions in this advertisement, prepared by Broadridge Investor Communication Services, Inc., are for general information only and are not intended to provide specific advice or recommendations for any individual.

RBC Wealth Management, a division of RBC Capital Markets, LLC, Member NYSE/FINRA/SIPC.

RBC Wealth Management does not provide tax or legal advice. All decisions regarding the tax or legal implications of your investments should be made in connection with your independent tax or legal advisor. No information, including but not limited to written materials, provided by RBC WM should be construed as legal, accounting or tax advice.

Past performance does not guarantee future results.

Prepared by Broadridge Advisor Solutions Copyright 2024.