Should You Buy or Lease Your Next Vehicle?

New vehicle prices have skyrocketed these past few years, with the cost averaging well over $48,000 toward the end of 2023.1 These increased costs, coupled with rising interest rates, mean that buying a vehicle can take a significant bite out of your budget. If you are in the market for a new vehicle, you might be wondering if leasing it would save you money.

As a rule, if you plan on keeping a vehicle for a long period of time, it makes more sense to buy it. But if having the latest technology and safety features is important to you, leasing might be the best option, allowing you to drive a new vehicle every few years. To help you decide, you should also determine how each option fits into your lifestyle or budget. Here are some points to consider.

Ownership

When you buy a vehicle, you usually finance a portion of the purchase price and pay it back over time with interest. When the loan term ends and the vehicle is paid for, you own it. You can keep it as long as you like, and any retained value (equity) is also yours to keep.

When you lease a vehicle, you don't own it — the leasing company does — so you do not have any equity built up once the lease is over. At the end of the lease term, you can choose to either return the vehicle or buy it at its residual value, which is set forth in the lease. If you end up returning it early, the dealer may require you to pay a hefty fee. If you still need a vehicle at the end of the lease term, you'll need to start the leasing (or buying) process all over.

Monthly payments

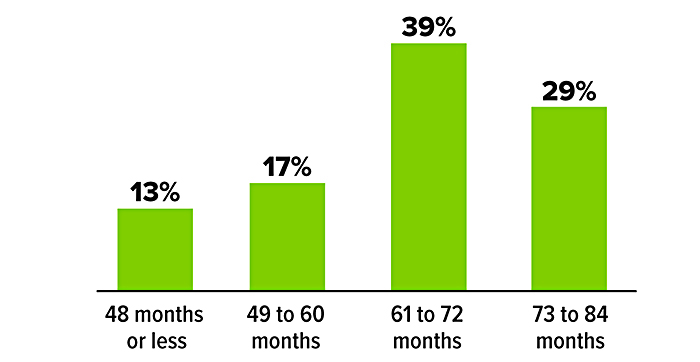

If you finance all or part of your new vehicle purchase, you will have a monthly payment that will vary based on the amount you finance, the interest rate, and the loan term. When comparing loans, it's important to look at the total amount of money you will end up paying over the life of the loan. While a longer loan term may give you a more affordable monthly payment, you will end up paying more money over the loan term.

In general, monthly lease payments are usually lower than monthly loan payments since you are mainly paying for the vehicle's depreciation during the lease term as opposed to the purchase price. This means that leasing may allow you to drive a more expensive vehicle than what you could otherwise afford.

Mileage

How much do you plan on driving? When you buy a vehicle, you can drive it as many miles as you want. However, a vehicle with higher mileage may be worth less if you plan to trade it in or sell it at some point down the road.

Vehicle leases come with up-front mileage limits, typically ranging from 12,000 to 15,000 miles per year. If you exceed these limits, you can end up incurring costly penalties in the form of excess mileage charges.

Maintenance

When you sell your vehicle, condition matters, so you may receive less if it hasn't been well maintained. As your vehicle ages, repair bills may be greater, something you typically won't encounter if you lease.

Generally, you will have to service a leased vehicle according to the manufacturer's recommendations. In addition, you'll need to return your vehicle with normal wear and tear (according to the leasing company's definition). Anything above normal wear and tear may result in excess charges.

Up-front costs

When you buy a vehicle, the up-front costs you incur may include the cash price or a down payment for the vehicle, taxes, title, and other fees.

The up-front costs associated with leasing a vehicle may include an acquisition fee, down payment, security deposit, first month's payment, taxes, title, and other fees.

Additional buying vs. leasing tips

Keep the following tips in mind when determining whether or not to buy or lease a vehicle:

- Shop wisely. Make sure you read the fine print and fully understand all terms or conditions.

- Negotiate. To get the best deal, be prepared to negotiate the price of the vehicle and the terms of any loan/lease offer.

- Run the numbers. Calculate both the short-term and long-term costs associated with each option.

- Consider tax implications. This is especially important if you use your vehicle for business and/or have an electric vehicle.

1) Kelley Blue Book, 2024

Susan H. Stewart, CPM, JD,

Senior Vice President – Financial Advisor

Senior Portfolio Manager – Portfolio Focus

NMLS #830330 through City National Bank

Individual CA License # 0M18772

RBC Wealth Management, a division of RBC Capital Markets, LLC | Firm CA License # 0C38863

Ph: (302) 493-9161 | e-mail: susan.h.stewart@rbc.com

The Stewart Group - RBC Wealth Management - Home

RBC Wealth Management, a division of RBC Capital Markets, LLC | Firm CA License #0C38863

Ph: (301) 907-2705 | e-mail: taylor.stewart@rbc.com

Investment and insurance products offered through RBC Wealth Management are not insured by the FDIC or any other federal government agency, are not deposits or other obligations of, or guaranteed by, a bank or any bank affiliate, and are subject to investment risks, including possible loss of the principal amount invested.

The information contained herein is based on sources believed to be reliable, but its accuracy cannot be guaranteed. RBC Wealth Management does not provide tax or legal advice. All decisions regarding the tax or legal implications of your investments should be made in connection with your tax or legal advisor. RBC Wealth Management is not a mortgage lender or broker. Nothing herein should be construed as an offer or commitment to lend. Any calculations are provided as educational tools, and are not intended to provide investment advice or serve as a financial plan. The result of any calculation performed is hypothetical and does not assume the effect of fees, commissions, tax rates, or changes in interest rates or the rate of inflation, and is not intended to predict or guarantee the actual results of any investment product or strategy. These results depend wholly upon the information provided by you and the assumptions utilized within. In selecting an anticipated investment return, you should consider factors affecting the potential return, such as investment objectives and risk tolerance. The articles and opinions in this advertisement, prepared by Broadridge Investor Communication Services, Inc., are for general information only and are not intended to provide specific advice or recommendations for any individual.

RBC Wealth Management, a division of RBC Capital Markets, LLC, Member NYSE/FINRA/SIPC.

RBC Wealth Management does not provide tax or legal advice. All decisions regarding the tax or legal implications of your investments should be made in connection with your independent tax or legal advisor. No information, including but not limited to written materials, provided by RBC WM should be construed as legal, accounting or tax advice.

Past performance does not guarantee future results.

Prepared by Broadridge Advisor Solutions Copyright 2024.